Document flow between organizations. Transition to exchanging electronic documents with counterparties: where to start, what you need to know What documents can be exchanged electronically

Any organization can organize electronic document management (EDF) and exchange electronic documents with its counterparties.

To do this, she needs to make changes to the accounting policy, issue an order to introduce EDI, enter into an agreement on the exchange of electronic documents, create a working group, and appoint responsible persons.

An agreement must be concluded with each organization with which you intend to exchange electronic documents. It needs to define the rules on the basis of which electronic documents will be created, transmitted and stored. It is necessary to specify what documents the parties will exchange, what signature will be used when signing certain electronic files.

You can use all 3 types of signatures established by Federal Law dated April 6, 2011 No. 63-FZ “On Electronic Signatures”:

- A simple signature is usually used to sign letters and specifications (formed using codes and passwords).

- A strengthened unqualified one will allow you to establish who signed the document (formed in the process of cryptographic transformation of information using an electronic signature key).

- A strengthened qualified signature is the most secure. It is issued only by accredited Certification Centers. To create and verify it, cryptographic protection tools certified by the FSB of Russia are used. This signature must be used to sign invoices and reports to the Federal Tax Service, the Pension Fund of the Russian Federation, the Social Insurance Fund, and Rosstat. Such a signature can be obtained at the Taksky training center. It will be possible to exchange electronic documents through the Taxcom-Filer software. And you can invite your counterparties to exchange electronic documents using 1C-Taxcom.

Taxcom specialists will be happy to answer all your questions and explain the conditions under which electronic documents will be exchanged.

To exchange data, it is not necessary that all participants be connected to the same EDF Operator. Roaming between electronic document management operators will help clients of different EDI operators exchange legally significant electronic documents with each other. What can be done to organize electronic document flow between counterparties? It is necessary to purchase licensed software, a server, update equipment, train staff to work with electronic signatures, explaining the advantages of the new technology. Process automation can take from several months to several years. However, the advantages are obvious: the organization will be able to instantly exchange electronic documents with its clients, suppliers, partners, departments, saving time.

This is especially true for large companies that are actively switching to EDI, reducing the costs of printing, delivery and storage of electronic documents.

And convenient search for documents, avoidance of penalties by speeding up interaction with regulatory authorities and other advantages make electronic document flow between companies indispensable.

In May 2012, the formation of the regulatory legal framework necessary to launch electronic document management was completed. Many enterprises and organizations are beginning to actively switch to paperless document flow with clients and suppliers. Among the advantages of this form of communication are a significant reduction in costs and time for preparing and sending documents, savings on materials, postal and courier costs, quick access to the electronic archive, convenient search for documents and much more. 1C methodologists tell us how to launch electronic document management in 1C:Enterprise 8.

The possibility of exchanging electronic documents between legal entities has existed since 2002 - from the moment when Federal Law No. 1-FZ “On Electronic Digital Signature” determined the equivalence of digital signature and handwritten signature in a paper document and established the basic “rules of the game” in the field of exchange of electronic documents. But until now, potentially very convenient electronic document management has not fully entered into Russian business practice - until recently, there were several “holes” in the legal framework. One of them is the inability to ensure a legally significant exchange of electronic invoices.

The real start of electronic document management in Russia can be considered May 23, 2012 - on this day the order of the Federal Tax Service of Russia dated 03/05/2012 No. ММВ-7-6/138 came into force, which approved electronic formats for invoices, logs of received and issued invoices , sales and purchase books. On May 2, the order of the Federal Tax Service of Russia dated March 21, 2012 No. ММВ-7-6-172@ came into force, which approves the forms of primary documents TORG-12 and the acceptance certificate for works (services). Unlike an invoice, these forms are of a recommendatory nature; when exchanging documents, companies can use forms other than the recommended ones. But in this case, such electronic documents cannot be accepted by tax authorities for consideration as legally significant (for example, for documentary verification).

We recommend reading more about the legal basis for the exchange of electronic documents in articles on 1C:ITS and on the website its.1c.ru:

- Legal force of documents signed with an electronic signature

- Confirmation of expenses and deductions with electronic documents

General scheme for exchanging electronic documents

Right now, many enterprises and organizations are beginning to actively switch to paperless document flow with clients and suppliers. Among the advantages of this form of communication are a significant reduction in costs and time for preparing and sending documents, savings on materials, postal and courier costs, quick access to the electronic archive, convenient search for documents and much more.

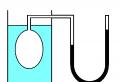

In general, the exchange of electronic documents looks like this (see the first diagram).

First, the seller creates a document in his accounting system. Then he “signs” it with his electronic signature using special cryptographic software. The next step is to upload the signed electronic document into the electronic document management operator program and send it to the counterparty, who will accept it into their installed program. Next, the buyer needs to enter the received document into his accounting system - to do this, he must either determine the correspondence between the received document and a document previously prepared in the information system, or create a copy of this document “from scratch.” After which the created document can be accepted for real accounting in your work program. The last stages are the most labor-intensive and uncomfortable.

Exchange of electronic documents in 1C:Enterprise 8

To eliminate as much as possible the reloading of documents from one program to another and “manual labor” when accepting a document into the recipient’s accounting system, 1C and the electronic document management operator Taxcom have developed a joint solution 1C-Taxcom. In fact, this solution is part of the “1C:Enterprise 8” configurations - it is built into “1C:Accounting 8”, “1C:Trade Management 8” (rev. 11), “1C:Manufacturing Enterprise Management 8” and other most popular solutions "1C". The internal integration of the accounting system and the operator’s program made it possible to eliminate the main technological shortcomings of the general scheme - using electronic document management has become much easier and more convenient (see the second diagram in the figure above).

In this scheme, the most labor-intensive stage of the overall electronic document exchange circuit is excluded. The integrated solution not only performs all the necessary functions, including sending and receiving documents, but most importantly, based on the received electronic documents, it automatically generates documents in the 1C:Enterprise 8 information base. Thus, the user receives the document in its usual form and can immediately accept it for accounting.

Let us note a few more advantages of this organization of document flow:

- all work with documents is carried out in the familiar 1C:Enterprise 8 interface;

- there is no need to separately install and update the electronic document management operator’s program or work on its web resource;

- The exchange of not only invoices is supported, but also other documents - invoices, acts, invoices, orders, etc.

Four steps to electronic document management

To technically connect the exchange of electronic documents using 1C-Taxcom, you need to follow several simple steps. Please note that for 1C:Enterprise 8 users who have a 1C:ITS contract, connection to the service is free, incoming documents are not charged or paid for.

1. Check whether the program has been updated to the version and release that includes the possibility of exchange (information is available on the website http://v8.1c.ru/edi/1c-taxcom/eldoc/). To work with electronic documents, the 1C:Enterprise 8 platform version no lower than 8.2.15 is required. If the version/release number of your program is lower than required, update the program. You can do this yourself, or by contacting a 1C partner or system administrator.

2. The service is connected based on an application. The exchange functionality is already in the program in “sleep” mode. To activate it, you need to fill out an application in the user’s personal account on the website http://users.v8.1c.ru.

3. After processing the application (usually the procedure takes no more than one working day), the user will be provided with Identifier of the participant in the exchange of electronic documents.

4. The last step towards paperless communication with your counterparties is setting up “1C:Enterprise 8”.

We will examine in detail how to perform such a setup using the example of the popular program “1C: Trade Management 8” (rev. 11).

Setting up "1C:Enterprise 8"

First in the section Administration We note that this program will use the exchange of electronic documents - we will check the appropriate “checkboxes”.

After this, a new group of commands will be available in all forms of documents participating in electronic document flow - , resend and other commands for quickly working with documents.

Let us remind you that to ensure legally significant electronic document flow it is necessary to use an electronic signature. In this case, any certificates issued by a certification center that is part of the network of trusted centers of the Federal Tax Service of Russia will be suitable. For example, if your company submits reports to the Federal Tax Service electronically, then such a certificate has certainly already been received, and it can be safely used to organize the exchange of electronic documents. If you don’t have a certificate, you can get one, for example, from a regional representative of the Taxcom company (http://www.taxcom.ru/about/regions).

Next, you need to perform general cryptography setup and setup of electronic signature certificates. To fill out the form Setting up cryptography(chapter Administration) you will need to indicate the name and general technical characteristics of the software that is used to work with the electronic signature (cryptoprovider of the electronic signature) - see Fig. 1. For some programs (for example, for CryptoPro) these technical characteristics can be filled in automatically.

Rice. 1

In order to be able to sign documents with the click of one button, without leaving 1C: Trade Management 8 and without switching to other modes, the electronic signature certificate (or rather, only that part of it that can be transferred and stored in an unprotected mode) must be transferred directly to the program. To do this, you must specify where the program should get this certificate from. In general, 1C developers recommend downloading a certificate from the operating system user’s personal certificate store (see Figure 2).

Rice. 2

For each certificate (and, in fact, for a specific official who has the right to sign), you should indicate a list of documents that he has the right to sign - therefore, we will list all types of documents on the tab of the same name (see Fig. 3).

Rice. 3

The next stage is also performed in the program; it is technically simple, but will require more time to implement. The point is to agree with your counterparties on the exchange of invoices and other documents in electronic form. Let us remind you that the exchange of electronic invoices requires the mandatory participation of a third party in the process - the electronic document management operator (in this case, the Taxcom company).

The list of counterparties with whom your company plans to switch to paperless document flow is maintained in the form Agreement with counterparties on the use of electronic documents (through EDI operators). By adding a new counterparty to this list, you can immediately send an invitation to electronic interaction.

Details on how to fill out agreements can be found in the methodological support section “1C:Enterprise 8” on the website its.1c.ruhttp://its.1c.ru/db/metod81#content:4791:1 and on 1C:ITS .

pay attention to Organization ID. This value is assigned to each organization by the electronic document management operator. If your counterparty accepts the invitation to electronic document management, a message will be sent from him indicating the identifier, and the form field will be filled in automatically. The status of the counterparty will also change - from We are waiting for agreement on Joined.

Don’t forget to respond to incoming invitations from your partners - you can confirm your readiness for electronic exchange using the command Update statuses from the service.

At this point, the technical preparation is completed, and you can proceed directly to the exchange of electronic documents. Let's look at how this is done in the program using the example of invoices.

Invoice: send and receive

Please note that two columns will now appear in the list of invoices, displaying the summary status of electronic document flow for information base documents. In the first column - the state of document flow on our part (for example, everything is done or action required), in the second - the state of other participants (the counterparty and the electronic document management operator). The user sees whether he needs to do something or just wait - see fig. 4.

Rice. 4

We will prepare a new invoice as usual. The program will tell you what action is required on our part- that is, we should sign and send the document to the partner. To do this, select the command Generate, sign and send from the newly created menu ED- see fig. 5.

Rice. 5

When you select this command, the program will automatically prepare an electronic document, sign it with an electronic signature (if you have the right to sign) and place it in the queue for sending. If the manager does not have signature rights, the program will first redirect the invoice to the responsible person for signature. On our part, all actions have been completed, now we are waiting for confirmation of receipt from the operator and from the buyer.

Now let's look at the process from the other side - from the side of the buyer, who receives a new invoice from his partner. Having received this document, the program will automatically create a similar document in the information base “1C: Trade Management 8” (rev. 11). Then you can work with it in the same way as with other invoices.

At first, when getting used to the new service, it may be convenient for users to view the received invoice in their usual form - like on paper. To do this, the program implements a viewing mode for an electronic document, which presents information in the usual printed form and contains a list of installed electronic signatures on the document. The contents of the form can be printed, and an additional sheet listing electronic signatures will be attached to the printout; it can be saved to disk - in this case, not only the electronic document itself is saved, but also the installed signatures in the form of additional files (see Fig. 6).

Rice. 6

Working with arbitrary documents

“1C: Trade Management 8” (rev. 11) supports the secure exchange of free-form documents, for example, contracts or reconciliation reports. A separate type of data is intended for this purpose, called Any electronic document. In fact, it is analogous to a regular email and allows you to fill out a covering note, attach the necessary files, set an electronic signature, send a document to the counterparty, etc.

The programs of the 1C:Enterprise 8 system have a whole set of useful service functions that make the process of moving electronic documents convenient, understandable and transparent even for inexperienced users.

Ensuring the legal validity of the exchange

In order to begin the exchange of legally significant primary documents with counterparties, it is necessary to make changes to the accounting policy. It is worthwhile to provide the ability to prepare and receive primary documents in electronic form, as well as accept these documents for accounting and tax accounting.

In addition, at the moment, a mandatory condition is that the parties conclude an Agreement on the exchange of electronic documents. It can be concluded either in the form of a separate document or in the form of an additional agreement to a specific contract.

In the first case, electronic documents can be exchanged within the framework of any agreement with a counterparty, in the second - only within the framework of the agreement to which an additional agreement has been concluded. The agreement can be concluded for any period.

An agreement on the exchange of electronic documents must be concluded in writing. At the same time, the legislation allows it to be concluded electronically using an electronic signature. However, in order to avoid misunderstandings with the counterparty and quibbles on the part of the inspection authorities, in this case it is better to use a paper form.

The Agreement on the exchange of electronic documents must specify:

- type of electronic signature used;

- procedure and sequence of signing electronic documents;

- actions of the parties if the other party does not accept the document for technical reasons;

- conditions for interaction of participants with the certification center (accredited certification center);

- conditions for recognizing electronic documents signed with an electronic signature as equivalent to similar documents signed manually (until July 1, 2012, this condition is mandatory for all Agreements; in the future, it is mandatory when using a simple or unqualified electronic signature. When using a qualified electronic signature, the parties may establish additional conditions recognition of this signature as equivalent to a handwritten signature).

A sample Agreement on the organization of electronic interaction is posted on the 1C:ITS website - http://its.1c.ru/db/eldocs#content:9:1

We recommend that users do not forget to contact the 1C partner who services the company under the 1C:ITS agreement and conclude a license agreement with him for the right to use the 1C-Taxcom software.

Special offer for 1C:ITS users

Let us remind you that until October 31, 2012 there is a special offer for 1C:Enterprise 8 users who have a valid 1C:ITS agreement - the ability to send up to 1,000 sets of documents per month for free (a set can include up to three documents, for example, an invoice) invoice, act/invoice, invoice). Above - the cost of sending a set of documents will be 10 rubles.

Electronic document management is often talked about a lot, but it is difficult to navigate a large number of new terms, and even more difficult to understand how it all works. The series of articles “The Accountant and the Electronic Document” was designed specifically to tell in an accessible language everything an accountant needs to know about this type of interaction. How to start an exchange? How to work with primary reports and submit reports electronically? You will find answers to these and other questions in our issues.

In the first chapter we will talk about how to switch to electronic interaction with counterparties, and what is needed to start an exchange.

View from above: is change needed?

Accounting is inextricably linked with the preparation of various documentation. Paper document flow schemes have been perfected for decades, but today paper documents are being replaced by electronic ones.Let's look at the current situation from above: many companies partially or completely automate their internal business processes through the implementation of information systems. But the functioning of an organization is not limited to internal processes; it is also necessary to interact with counterparties.

For example, after completing a business transaction, an accountant draws up a work completion report in his accounting system, prints it out and sends it by mail or courier. The counterparty, having received the act, scans it and enters it into the information system, if any. Then the accountant manually makes entries in the accounting system, and without fail saves the paper original. Comfortable?

The situation is paradoxical: internal processes are optimized, but external ones are not, while it is externally streamlined processes that lead to a real minimization of costs, both material and time. Delivery of paper documents takes up precious days and weeks, while electronic documents are transferred within minutes.

Methods for exchanging electronic documents

- So, you have decided to start exchanging electronic documents. The counterparties decide independently how electronic interaction will be structured. There are two main types of exchange:

- Exchange with the counterparty directly You can start by concluding a preliminary agreement, which spells out in detail the procedure and conditions of the exchange. If both counterparties use an enhanced qualified electronic signature, then the agreement does not need to be concluded; accordingly, with other types of electronic signature, an agreement is required. The obvious advantage of this option is that you do not need to pay operators for transmitting documents; you can use regular email. But not all documents can be sent directly to the counterparty.

- Another variant - exchange of invoices through an electronic document management operator (EDO operator SF). This method is better, if only because you connect to the operator’s network once, join the exchange regulations and work in the service. EDF operators of the Northern Fleet have the technological, personnel and legal capabilities to ensure the legitimate exchange of any electronic documents, and, most importantly, invoices.

Karina Kassis,analystSynerdocs

Three simple steps to EDI

- connect to the operator;

- purchase an electronic signature certificate and cryptographic protection means (CIPF);

- connect counterparties (if necessary) using an operator

Connecting to an operator

First of all, contact the operator, discuss the cost and terms of connection. When starting an exchange, you need to sign an agreement with the operator; this procedure is often called joining the regulations.The regulations are a document that describes in detail the principles of operation, tasks of the service and legal aspects.

Purchasing an electronic signature certificate and cryptographic protection means

You can obtain an electronic signature certificate at any Certification Center accredited by the Ministry of Telecom and Mass Communications of the Russian Federation (List of accredited CAs). Often SF e-document flow operators are CAs themselves or provide services for obtaining certificates through their partners.According to Federal LawN63 “On Electronic Signature”, an electronic signature certificate used by a company (legal entity) also identifies a specific individual, but acting on behalf of the company on the basis of the Charter or power of attorney. Of course, certificates cannot be transferred to other persons. You cannot have someone sign your autograph on documents.

Karina Kassis,analystSynerdocs

An electronic signature (ES) is a certain sequence of characters that is attached to a document. There are three types of signatures: simple, enhanced unqualified, enhanced qualified.

According to Federal Law No. 63 “On Electronic Signatures,” an electronic document signed with a simple or enhanced unqualified electronic signature is recognized as equivalent to a paper document signed with a handwritten signature.

An enhanced qualified signature on an electronic document is analogous to a handwritten signature and seal on a paper document. The Federal Tax Service recognizes the legal force only of those documents that are signed with a qualified signature .

A cryptographic information protection tool (CIPF) is a special program that encrypts and decrypts transmitted information. CIPF in exchange services is necessary to create and verify an electronic signature. A license for the right to use can be purchased through the operator.

Connecting counterparties

Of course, you can exchange electronic documents only with those counterparties who are already connected to the exchange service. Similarly with social networks: there is no point in registering if there are no friends there. However, others may follow your company in experimenting. There are situations when counterparties only need additional motivation, preferential or free access for a while. The EDO SF operator will help you solve all your questions, since he himself is interested in high-quality support for his users and connecting new subscribers.It does not matter which EDF operator the SF operator uses - you can be connected to one operator, and the counterparty to another. Today, a number of leading operators are developing and testing roaming technology. While the technology is at the development stage, you can use other options for organizing interaction with counterparties.

The first option is to work with multiple operators . No one prohibits exchange participants from using the services of several EDF operators. You yourself can connect to several operators, or offer this method of work to a counterparty, if appropriate, of course.

If you and your counterparty are connected to different services, and for some reason do not want to use the services of several electronic document management operators, then pay attention to the second option is that you can contact your operators with a proposal to establish an exchange between themselves.

Instead of a conclusion

Let's summarize briefly: what do you, as an accountant, need to know about how to start exchanging electronic documents with counterparties? Firstly, the legal force of the document is ensured by an enhanced qualified electronic signature. Secondly, the EDF operator SF guarantees fast delivery and integrity of the electronic document. Thirdly, in order to start exchanging through an operator, it is enough to join the regulations, as well as purchase an electronic signature certificate and a cryptographic protection tool. The solution to other issues actually falls on the shoulders of the operators.In the next issue

In the second chapter, “Accountant and Electronic Document,” you will learn where else you can use electronic signatures and how to distinguish all three electronic signatures from each other. We will take a closer look at the signing mechanism and find out which electronic document is recognized as legally binding. You will also learn where and how to store electronic documents while maintaining their legal force.One of the key tasks of an enterprise is to create certain conditions for interaction and work with other companies. It is for this reason that currently all companies are trying to switch from paper to electronic document flow between organizations. In the very near future, this method of data transfer will become the main one for all enterprises in our country. Moreover, the legislation of the Russian Federation now allows the use of such systems legally.

How is electronic document flow carried out between different companies?

In order for an enterprise to be able to exchange data with other companies that are significant to it, it must carry out a special procedure for implementing the appropriate software package. Its option can be chosen as desired. The use of such a system makes it possible to quickly send and receive important information from other companies, using the appropriate telecommunication channels.

Such a software package usually includes:

- address book with the necessary contacts;

- the ability to transmit or receive documentation such as invoices, supply contracts, etc.;

- integration with other types of systems used by the company's partners;

- storing and organizing outgoing or incoming letters;

- electronic digital signature and encryption of sent files;

- support for business documentation and informal data (implemented through the use of specially developed standards).

Advantages of implementing and using electronic document management

The main advantages of using systems for electronic information exchange are:

- Significant reduction in the organization’s budget costs for sending documentation to other companies. This is due to the absence of the need to incur costs for postage or maintaining a courier on staff.

- The opportunity to significantly save space in the office, since all data will be stored in electronic form, and not in separate rooms when paper media are used.

- Prompt receipt of data by other organizations. This will take literally a few seconds.

- The system is easy to use and easy to use. An employee can easily find the required file according to certain criteria, compile documents using templates, and track the transfer of data to other companies.

How is the legal significance of sent and received information ensured?

If an organization plans to exchange documentation with its partners, then it should include all information about them in its accounting policy. In this case, it will be necessary to provide for such important points as receiving certain files and accepting the information contained in them for tax or accounting purposes.

In addition, the country's legislation currently obliges all Russian enterprises to draw up a special agreement that allows the exchange of documentation submitted in electronic form. It can be concluded either as an addition to the main agreement with a specific company, or as a separate document. The first option involves receiving and sending data relating only to a specific contract, and the second does not prohibit the exchange of any information. This document can be drawn up and signed for any period.

It would be more expedient to draw up an agreement on the exchange of electronic documents using paper media, since this will allow you to avoid any problems associated with partners or inspection authorities in the future. Although the company has the opportunity to compile it also in electronic form, for the reliability of the information it will be necessary to apply an electronic digital signature.

An agreement providing for the exchange of information between enterprises must have the following clauses:

- Type of electronic digital signature used.

- Conditions and order of signing all documentation.

- Procedure for connecting companies with a certification authority.

- Rules of conduct for employees in a situation where a document cannot be accepted due to lack of technical capabilities.

- Conditions under which an electronic digital signature is valid and equivalent to a handwritten one.

Electronic document management in an organization provides extensive opportunities not only to simplify its business processes, but also allows you to quickly and conveniently interact with counterparties, on whom the performance of the enterprise directly depends. That is why today all successful companies must switch from routine paper-based work to an improved method of exchange between their partners.

Application of electronic document management (EDF) in an organization

In order to understand what electronic document management (EDF) is and why it is needed, you should know the general principle of document management. Namely:

- What primary documents are drawn up at the enterprise;

- How these documents are exchanged within the enterprise and with third parties;

- Who draws up and checks the execution of primary documents;

- Who has the right to sign documents?

Each enterprise has developed an individual document flow schedule that helps employees understand and determine the movement of documents.

EDI first appeared in the banking sector, then EDI systems began to be used in many Western enterprises. Currently, EDI is widely used in Russia for the rapid exchange of information.

EDI is a fast and high-quality exchange of various information both within the enterprise and with external contractors or regulatory authorities. Timely identification of errors and discrepancies in settlements between counterparties, as well as reconciliation of the buyer and supplier data with the Federal Tax Service data, allows you to quickly identify discrepancies in invoices.

For example, when exchanging documents with counterparties using EDI, and not using postal services, the enterprise will save not only the time of document execution: printing the document, collecting signatures, issuing envelopes, etc., but will also reduce the cost of postal services.

Documents processed using EDF, according to the law, have the same legal force as on paper. All contracts, agreements and other similar documentation have legal force in accordance with the Civil Code of the Russian Federation. The Tax Code also provides for electronic documentation, which has the same force as paper documents.

How to organize the exchange of electronic documents (EDI) in 1C 8.3 - step-by-step instructions

In the program 1C 8.3 Accounting ed. 3.0 provides a function designed for the use of EDI. Let's look at the rules for setting up and working with EDI in 1C 8.3 as an example.

Step 1. Setting up electronic document management in 1C 8.3

To work with EDI in 1C 8.3, you must first configure the program, namely:

- Perform updates to the current release;

- Conclude an agreement with a telecom operator for the transfer of electronic data. You can work with the operator through which you send reports to the Federal Tax Service and extra-budgetary funds;

- Receive a password and login for Internet support of the 1C company serving the enterprise;

- Install crypto-pro on your computer or obtain an electronic digital signature on a flash drive.

Attention! In the “Counterparties” directory, the name of the counterparties must be filled in according to the Federal Tax Service, so that in 1C 8.3 the data is correctly filled in: name of the organization, INN/KPP, address and code of the Federal Tax Service.

To do this, go to the “Directories” menu, where we select the “Counterparties” directory:

In the list of counterparties that opens, check that the data on the everyone counterparties. To do this, hover the cursor over the desired counterparty and use the “More” button to select the editing function “Change”:

The counterparty card opens:

If the counterparty’s TIN has already been entered into the card, then click the “Fill in by TIN” button, after which information about the checkpoint, name and address is automatically filled in according to the Federal Tax Service.

The address must be filled out not in a free format, but according to the data of the address classifier. But to do this, you need to configure the connection of the 1C database to the Internet and the Federal Tax Service server.

Step 2. Setting up EDI and cryptography

Go to the “Administration” section and select the “Electronic Document Exchange” function:

The “Setting up electronic document exchange” window opens:

To work with EDF in 1C 8.3, you should check the “Electronic signatures” and “Exchange of electronic documents with counterparties” functions:

Then you should make sure that the electronic signature is configured. To do this, go to the “Electronic signature and encryption settings” menu on the “Programs” tab, where the installed key should be displayed. If the key is not installed, you should contact a specialist to install it:

Step 3. Connect electronic document management

The next step is to connect to the 1C EDF service. To do this, select the functions “Connect to the 1C EDF service” and “Connect to the 1C Taxcom service”:

When you connect to EDF and TAXCOM services, the connection assistant opens. Following the prompts of the 1C 8.3 program, we go through the filling stage:

Next, go to the EDF settings in 1C 8.3, where an automatically configured template for exchanging electronic documents with counterparties opens. In the “Organization” field, you must select the legal entity to which you want to send an invitation to electronic exchange of documents. After this, by clicking on the “Record and close” button, an invitation to connect to the EDF will automatically be sent to the selected counterparty:

To update EDF forms in 1C 8.3, you should check the box “Switch to new forms automatically”:

In 1C 8.3 you can set up a schedule for exchanging electronic documents:

Or watch our video tutorial:

Step 4. Working with EDF

When generating primary documents in the 1C Accounting 8.3 program, it should be noted that in the menu of the document for which the electronic document management form has been approved, there is an “EDF” button. All actions with such primary documents can be performed according to the selected command:

To view all information about the movement of documents through EDF, in 1C 8.3 there is the “EDF Archive” function in the “Administration” menu:

In the archive you can view all transactions performed with documents in EDI. Using bookmarks and the settings menu, in 1C 8.3 you can get various reports on the types of documents and the degree of their execution:

To work in the current mode with EDF in 1C 8.3, you should use the “Current EDF Affairs” function, which is located in the “Sales” section:

Or in the "Shopping" section:

Where you can also generate the necessary reports:

To exchange arbitrary electronic documents with suppliers or customers in 1C 8.3, the “Arbitrary electronic documents” function is intended:

In this service, you can select a file of any format or a specified format from the drop-down list:

Or select a document of a custom or established format from the drop-down list and also send it to your counterparty.