How else can you call double counting? Double entry principle: how to prepare accounting entries? Double entry in accounting

First of all, let's define the concept. Double entry is a way of reflecting business transactions and economic facts in accounting, which allows you to systematize and group the facts of a subject’s economic activity according to individual characteristics.

In other words, the double entry method in accounting means the reflection of the facts of the enterprise’s economic activity on interconnected accounting accounts, which are regulated in the organization’s working chart of accounts. Consequently, one transaction must be reflected as a debit to one account and at the same time as a credit to another, and in one total amount.

Deviations from this rule violate key accounting principles.

The essence of the concept

In accordance with the provisions of Law No. 402-FZ, the principle of double entry in accounting must be applied everywhere. There are no exceptions to this rule. That is, all economic entities are required to use this principle when organizing and maintaining accounting records.

The essence of double entry is that each transaction must be reflected as a debit and a credit simultaneously on two accounting accounts. Moreover, entries are made taking into account the account attribute (active, passive, active-passive). That is, not only an increase, but also a decrease can be reflected in the debit of the account, and vice versa in the credit.

Examples

Let's look at the key essence of this principle using specific examples.

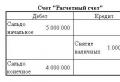

Operation: “The organization’s funds are withdrawn from the current account and deposited into the cash register for cash payments.”

Debit 50 Credit 51.

Account 50 “Cashier” and 51 “Current Account” are active. That is, the debit of active accounting accounts reflects an increase, and the credit, respectively, a decrease. Consequently, there are fewer funds in the current account - we reflect the movement on the loan, and the increase in cash in the cash register - on the debit. However, the total value of the enterprise's assets has not changed, the structure of assets has been adjusted (increase in cash, decrease in non-cash funds).

As you can see, double entry ensures the relationship between synthetic accounting accounts. But in fact, this principle shows a direct connection between the property, assets, liabilities of the institution and the sources of their formation.

Operation: “Purchase of inventories for production.”

Debit 10 Credit 60.

Account 10 “Materials” is active, and account. 60 “Settlements with suppliers and contractors” - active-passive. Therefore, according to count. 10 the increase is reflected in the debit, and for the account. 70 - the loan reflects the increase in the creditor to the supplier of materials.

The simultaneous change in the turnover of the debit and credit of the accounting accounts equalizes the balance. In other words, DZ equalizes the indicators of assets and liabilities.

Double entry in reporting

The key feature of the DZ principle, as we noted above, is the alignment of the institution’s assets and liabilities according to the accounting accounts used to reflect transactions in the reporting period. That is, when maintaining accounting according to established rules, asset indicators must be equal to liability indicators for the reporting period or as of a specific date.

If this principle is violated, it is impossible to generate reliable and complete reporting. These discrepancies will be identified in all forms of accounting without exception.

For example, if the DZ principle is violated, the balance sheet indicators (Form No. 1) for assets and liabilities will not be equal. Let's consider the form of the balance sheet of a non-profit organization:

As we can see, the asset and liability indicators of the reporting form are equal.

— a necessary requirement for monitoring accounting records when reflecting business transactions. From this article, the reader will learn about the basic rules for recording financial and economic transactions in accounting accounts.

Reflection of facts of economic activity

All financial and economic transactions carried out by business entities during their work must be recorded in accounting in the form of accounting entries using special accounts that have their own unique number.

Transactions are accumulated in accounts according to a certain characteristic (for example, information on fixed assets is recorded on account 01).

Active and passive accounts

According to their economic meaning, accounts are divided into active and passive.

Active ones are used directly to account for the state and changes in the organization’s funds in the context of the types of their formation (for example, accounts 01, 04, 10, 20, 50, 51).

On these accounts, the initial and final balances, as well as increases in funds, are displayed on the debit side of the account, and decreases in funds are displayed on the credit side of the account.

Passive accounts serve to reflect the direct sources of formation and movement of the organization’s funds (for example, accounts 66, 67, 70, 80, 86).

In passive accounts, the beginning and ending balances, as well as increases in funds, are recorded against the loan. A decrease in economic assets is shown as a debit.

Double entry

All transactions directly carried out by an organization in the course of its work are reflected in the accounts simultaneously as a debit to one account and a credit to another account. This method, called double entry in accounting, provides direct interconnection of accounts, and also has a control value. The only exception to this rule is off-balance sheet accounts, which reflect property that does not belong to the organization or assets and liabilities that are not taken into account on the balance sheet. In this case, the entry reflects only acceptance or deregistration.

Example

The Omega organization purchased fixed assets in the amount of 600,000 rubles. without VAT and put it into operation.

The accountant will prepare the following entries:

- Dt 08 Kt 60 - 600,000 rub. — an object of non-current assets was acquired.

- Dt 01 Kt 08 — 600,000 rub. — the main asset has been put into operation.

- Dt 60 Kt 51 - 600,000 rub. — payment has been made to the supplier.

All facts of economic activity recorded using the method are recorded on accounts in chronological order.

At the end of the period, the sum of the debit turnover of all accounts and the sum of the credit turnover of all accounts must be equal.

Chart of accounts

To uniformly summarize the facts of economic activity using the method double entry accounting The Russian Ministry of Finance approved the chart of accounts for all economic entities. Directly on the basis of this document, the accountant of the business entity creates a working chart of accounts.

You can read more about it and, if you wish, download the chart of accounts in the article .

Accounting accounts are divided into synthetic and analytical. The names and numbers of synthetic accounts are given in the chart of accounts. Synthetic accounts serve directly to group the financial indicators of the activities of a business entity.

Business transactions directly systematized into groups on accounting accounts in monetary terms as of a certain date constitute the balance sheet. The balance sheet looks like a table and consists of assets and liabilities.

You can read about what a balance sheet is and how to draw it up in the following articles:

- ;

- .

Analytical accounts serve directly for a detailed analysis of business transactions, for example: by cost centers, by suppliers, customers, budgets, employees.

Example

In May, Omega LLC made payments to suppliers in the amount of 630,000 rubles from a current account with Sberbank PJSC, including:

- Organization "Granit" transferred an advance in the amount of 20,000 rubles.

- Organization "Market" paid for the supplied goods (tables) in the amount of 350,000 rubles. without VAT.

- The Stroika organization carried out office renovation work for Omega LLC in the amount of 260,000 rubles. excluding VAT, and Omega LLC fully paid for the work performed.

The accountant reflected these transactions with the following entries:

- Dt 60 Kt 51 - 630,000 rub.

- Dt 41 Kt 60 - 350,000 rub.

- Dt 26 Kt 60 - 260,000 rub.

In analytical accounting, these operations will be reflected as follows:

- Dt 60"Omega"Kt 51« Sberbank» — 20 000;

- Dt 60« Market» Kt 51« Sberbank» — 350 000;

- Dt 60"Omega"Kt 51« Sberbank» — 260 000;

- Dt 41 Table Kt 60« Market» — 350 000;

- Dt 26 Repair Kt 60"Omega" — 260 000.

Results

Double entry in accounting directly ensures the relationship of business transactions and has a control value for the equality of the totals of entries in the accounts.

Macroeconomic agents

In macroeconomics, four economic agents are considered:

§ Households- are the owners of economic resources (factors of production), the main consumers of goods and services. As income, wages are received for the firms' use of labor: the main resource produced by households. They pay taxes to the state and receive the necessary transfers from it, such as pensions, unemployment benefits, student scholarships, and others.

§ Firms-- the main producers of goods and services, the main goal: maximizing their own profits. They are the main borrowers on the securities market. Firms make profits from investments in goods and services. The main expenses of firms are taxes, investment expenses and payments to households for resources.

Households and firms form private sector of the economy.

§ State-- the main producer of public goods, main goals: redistribution of national income, regulation of the economic activity of other agents and markets. Receives taxes - its main source of income, pays transfers to households and subsidies to firms, if necessary, makes purchases on the goods market. The state is inextricably in contact with the financial market.

The private sector and the state form closed economy.

§ Foreign sector-- international trade, circulation of capital and securities.

All four macroeconomic agents form open economy.

Macroeconomic markets

Market of production factors

Economic resources (or factors of production) are considered to be land, labor(labor market), physical and financial capital. Some economists also add to this list human capital: abilities, talents of people that allow increasing productivity.

Market of goods and services

It is in this market that the formation of aggregate supply and demand occurs. At the same time, demand for goods is presented by all macroeconomic agents, while supply is created by firms, the main producers of goods and services. Since real values are exchanged in this market, it is also called real market .

Financial market

Main article: Financial market

The financial market consists of:

§ Money market where the formation of supply and demand for money occurs, the study of the equilibrium interest rate and money supply

§ Securities market: the market for financial assets such as stocks and bonds

Circular flow model

Macroeconomic analysis is based on the simplest circular flow model. In its elementary form, it includes only two categories of economic agents - households and firms– and does not imply government intervention in the economy, as well as any connections with the outside world

The main conclusion from the model is the equality of the total sales of firms to the total income of households.

From the circular flow model it is clear that:

· real and cash flows are carried out unhindered, the condition for this is that the total expenditures of households, firms and the state (as well as the outside world, or abroad, for an open economic system) are equal to the total volume of production;

· aggregate spending causes growth in employment, output and income;

· the expenses of economic agents are again financed from income, which again return to the owners of production factors.

Leaks – any use of income other than for the purchase of domestically produced products.

At the same time, additional funds are poured into the “income-expenses” flow in the form of “injections” - investments, government spending, exports.

Injections are cash flows that are generated by investments, government purchases of goods and services, and payments for goods and services sold abroad. Total injections equal leaks

Subject- person, group of people, state.

Object – economic research. sciences, economic phenomena.

The subject is the life activity of people in the problems of economic management.

Economic agents are a person, a group of people, a state, playing a role in economic relations, which take part in the production, distribution, exchange and consumption of economic goods.

The subjects at the macro level are:

- The household sector, which includes all private households in the country whose activities are aimed at meeting their own needs. Households act as suppliers of all economic resources (factors of production) and at the same time as a spending group in the national economy. They are the holders of income (salaries, interest, profits). Household expenditures - taxes, personal consumption and savings. Thus, households engage in three types of economic activity: offering economic resources, consuming part of the income received, and saving.

- The business sector that performs the work of producing and distributing goods and services. It is represented by the entire set of enterprises (firms) that are registered and operate within the country. The business sector carries out the following types of economic activities: invests, offers the results of its activities, and places demand for factors of production.

- The public sector is all state-owned enterprises, institutions and agencies. The state produces public goods to meet the needs of the population, ensures the development of fundamental sciences and the implementation of national programs, the functioning of social and industrial infrastructures.

- The foreign sector, which includes all economic entities located outside the country, as well as foreign government institutions. The impact of foreign countries on the domestic economy is carried out through the mutual exchange of goods, services, capital and national currencies.

Subjects of macroeconomics take part in the circulation of resources, products and income (national economic circulation).

System of National Accounts- a system of interrelated indicators and classifications used to describe and analyze the macroeconomic processes of a country with a market economy.

The first version of the system was developed in 1951 and approved in 1953 by ECOSOC. The second version was approved by ECOSOC in 1968. The third version was approved in 1993. The current version was adopted in 2008.

Key indicators in the SNA there are three indicators of total product: gross domestic product (GDP), gross national product (GNP), net national product (NPP) and three indicators of total income: national income (NI), personal income (DI), disposable personal income ( RLD). GNP = GDP + NFA

GDP = GNP – NFA

GDP– the total market value of all final goods and services produced in the country by residents and non-residents during one year.

Double counting is the inclusion of the value of intermediate goods in GDP, resulting in multiple counting of the same good or service.

Value added - the difference between the amount of sales of the company

and the amount for which the company purchases raw materials from

suppliers. Added value eliminates double counting,

which arises from the counting of intermediate products,

goods that are completely consumed in the production of final

goods and services. In the economy as a whole, value added is equal to

the cost of the final product, that is, GDP is equal to the sum

added value of all firms.

PERSONAL CONSUMER SPENDING- individual's expenses on consumer goods and services. The magnitude of such expenses depends on personal disposable income and the prices of goods and services.

Gross Investment. These are all investments over a certain period of time aimed at developing production and increasing material, technical and commodity assets.

Net Investment It is the gross investment minus depreciation deductions over a specified period of time. Depreciation charges are funds intended for the restoration of resources spent in production, including wear and tear of equipment and its modernization

Gross Investment = Net Investment + Depreciation.

NET EXPORT- the difference between exports and imports of exported goods.

NET TAXES- taxes paid by the population to the state, minus transfer payments that the population receives from the state.

INDIRECT TAXES- taxes on goods and services, established in the form of surcharges on the price of goods or on tariffs for services and not depending on the income of taxpayers (unlike direct taxes related to income).

Gross National Product- a macroeconomic indicator that includes the cost of a product created in the country itself and abroad using factors of production owned by the country.

GROSS DOMESTIC PRODUCT (GDP) DEFLATOR- price index for all final goods and services, the cost of which is included in the GDP of the country or region. Represents the ratio of nominal GDP, expressed in current year market prices, to real GDP, expressed in base year prices.

PAASCHE INDEX- an indicator of the price level, calculated on the basis of a changing set of goods. This indicator is commonly known as the gross national product deflator.

LASPEYRES INDEX- an indicator of the price level, calculated on the basis of the prices of a certain set of goods.

ECONOMIC EQUILIBRIUM- the state of the economic system, market, characterized by the presence of balance, the balancing of two differently directed factors. For example, the balance of supply and demand, production and consumption, income and expenses. Equilibrium can be unstable, short-term, and stable, long-term.

General economic equilibrium(OER) - a state of the national economy when there is a balance between resources and their use; production and consumption; material and financial flows.

Aggregate demand- the real volume of products produced in society (essentially “GDP”) that consumers are willing to purchase at each given price level in the economy.

AD = C + I + G + X n

Where AD- aggregate demand; WITH- consumer spending; I- gross domestic private investment; G- government procurement of goods and services; Xn- net exports.

|

| | | next lecture ==> | |

| | |

The movement of property (economic assets) in organizations is reflected in accounting records in the form of separate business transactions. Business transactions are reflected in accounting accounts using the double entry system (method).

The double entry system originated during the Renaissance. Its first systematic description appeared in 1494 (two years after Columbus discovered America). It was given by Luca Pacioli, a Franciscan friar and friend of Leonardo da Vinci. The great German poet Goethe called double entry (double bookkeeping) “one of the most wonderful inventions of the human mind.” The outstanding economist and sociologist Werner Sombart believed that “double entry was brought to life by the same spirit as the systems of Galileo and Newton” [ 23 ].

The double entry system is based on the principle of duality, which states that all economic phenomena have two aspects: increase and decrease, donation and acquisition, emergence and disappearance, which compensate each other (this understanding of the principle of duality was characteristic of the remarkable Russian accountant A.M. Galagan ).

Many modern economists also believe that the method of double entry of business transactions in accounting is determined not so much by the technique of maintaining accounting records, but by the economic nature of the change in the form of value in the process of circulation of funds. In the process of circulation, each business transaction leads to the transfer of value from one form to another. The initial and final forms of value in the production process turn out to be different. All this makes it necessary to reflect each form of value in its original and final form. There are other opinions of economists, some of whom believe that double entry has legal content (the interconnected reflection of economic processes on accounts has a legal basis for connections), others - that double entry is a logical construction suitable for reflecting any numerical values, etc. .

Each theory has its positive and negative sides. All of them deserve scientific attention and understanding of their content when studying accounting theory.

In the double entry system, any fact of economic life (business transaction) must be recorded at least twice: in the debit of one account and in the credit of another account so that the total amount of the debit balances the total amount of the credit.

Double entry rules suggest that at least two accounts are required to record any business transaction, i.e. there must be one or more debitable accounts and one or more credited accounts. The total of entries for the debit of accounts must be equal to the total of entries for the credit of accounts.

Thus, according to the existing methodology, each business transaction is recorded twice in order to be reflected in the accounts: once on the debit of one account and the second time on the credit of another account, and for the same amount.

Double entry is a way of reflecting facts of economic life on accounting accounts in order to summarize information in monetary terms about the property, obligations of the organization and their movement.

Let us give examples of recording transactions in accounting accounts using the double entry method.

First operation . From the organization's cash desk, 500 rubles were issued to the organization's employee for reporting. for travel expenses. This transaction affects two accounts. Both accounts are active in relation to the balance, since funds are reflected on them. This operation caused a decrease in the amount of cash on hand and an increase in the debt of the accountable person. Therefore, the amount is 500 rubles. will be recorded as a debit to the “Settlements with accountable persons” account and a credit to the “Cash” account.

The accounting entry will be as follows:

Debit of the account “Settlements with accountable persons”.........500 rub.

Credit to the “Cashier” account................................................................. .......500 rub.

Account "Settlements with accountable persons" Account "Cash"

Debit Credit Debit Credit

1) 500 Sleep – 3000

Second operation . By decision of the founders of the organization, part of the retained earnings was added to the authorized capital in the amount of 20,000 rubles. This operation causes changes in passive accounts that are in the liabilities side of the balance sheet. Entries in the accounts should be made in the debit of the “Retained Earnings” account and the credit of the “Authorized Capital” account for the same amount.

Debit of the “Retained Earnings” account.............. RUB 20,000.

Credit to the “Authorized capital” account.................................20,000 rub.

Schematically it looks like this:

Account “Retained earnings” Account “Authorized capital”

Debit Credit Debit Credit

1) 20000 1) 20000

Third operation . Materials worth 15,000 rubles were received from suppliers. The cost of materials has not yet been paid to suppliers. This operation affects the active account “Materials” and the passive account “Settlements with suppliers and contractors”. As a result of the business transaction, there was an increase in materials (balance sheet asset) and an increase in accounts payable to suppliers (balance sheet liability) in the amount of 15,000 rubles.

The accounting entry will look like this:

Debit of the “Materials” account.............................................. RUB 15,000 .

Credit to the Accounts Payable account

and contractors"................................................... .......15,000 rub.

Schematically it looks like this:

Account “Materials” Account “Settlements with suppliers and contractors”

Debit Credit Debit Credit

1) 15000 1) 15000

Fourth operation . Cash was issued from the cash register to the organization's employees to cover arrears of wages in the amount of 1,000 rubles. This operation affects the active account “Cash” and the passive account “Settlements with personnel for wages”. As a result of the business transaction, there was a simultaneous decrease in funds (balance sheet asset) and sources of their formation (balance sheet liability) in the amount of 1,000 rubles.

The accounting entry will look like this:

Debit of the account “Settlements with personnel for wages”........................ 1,000 rubles.

Credit to the “Cashier” account................................................... .......................1,000 rub.

Schematically it looks like this:

Account "Settlements with personnel for wages" Account "Cash"

Debit Credit Debit Credit

SNP - 1000 Sleep - 1500

The considered examples of business transactions are characterized by duality and reciprocity.

Double entry is the basis for maintaining the specified properties and monitoring the records of business transactions in the accounting accounts.

The relationship between accounting accounts formed through double entry of business transactions is called correspondence of accounts , and the accounts themselves - corresponding .

To register business transactions on accounts, an account correspondence scheme is drawn up. A written reflection of the correspondence scheme of accounts and the amount of a business transaction is called wiring (notation, counting formula ).

Postings (records) can be simple or complex. When two accounts correspond - one for debit and the other for credit - a simple wiring .

Accounting records (accounting formulas), as a result of which one debit account corresponds with several credit accounts and, conversely, several debit accounts correspond with one credit account, are called complex wiring .

Double entry in the system of accounts provides not only an interconnected reflection of the movement of economic assets and sources, but also their systematization and grouping according to qualitatively homogeneous characteristics.

All accounting records are compiled on the document that documents the transaction. Each accounting transaction is assigned its own serial number, under which it is then listed in accounting.

Business transactions are recorded on accounting accounts as they occur in calendar order. Such records are usually called chronological . A chronological record serves as an important means of monitoring the safety of documents, the timeliness and completeness of recording transactions in accounts. Registration of business transactions according to a certain system of accounting accounts is usually called systematic recording.

Chronological and systematic records are carried out separately or together. When recording separately, transactions in chronological order are reflected in a special logbook in the following form.

Rice. 29.3 Investment function The larger part of the increase in income is invested, the greater will be the income of society (Fig. 29.3). The main factors of investment instability: – long service life of equipment; – irregularity of innovations; – variability of economic expectations; – cyclical fluctuations of GDP. The discrepancy between investment and savings plans causes fluctuations in the actual volume of production around the potential level, as well as a discrepancy between the actual level of unemployment and the natural one. These fluctuations are facilitated by the low downward elasticity of wages and prices (i.e., if prices go down, then wages do not, since this threatens the loss of qualified workers) Government expenditures and taxes: Public, or government, expenditure refers to the costs of maintenance of the institution of the state, as well as public procurement of goods and services. Government procurement of goods and services can be of various types: from the construction at the expense of the budget of schools, medical institutions, roads, cultural objects to the purchase of agricultural products, military equipment, and samples of unique products. This also includes foreign trade purchases. The main distinguishing feature of all these purchases is that the state itself is the consumer. Usually speaking about public procurement, they are divided into two types: procurement for the state’s own consumption, which is more or less stable, and procurement for market regulation. Expenses

Rice. 29.3 Investment function The larger part of the increase in income is invested, the greater will be the income of society (Fig. 29.3). The main factors of investment instability: – long service life of equipment; – irregularity of innovations; – variability of economic expectations; – cyclical fluctuations of GDP. The discrepancy between investment and savings plans causes fluctuations in the actual volume of production around the potential level, as well as a discrepancy between the actual level of unemployment and the natural one. These fluctuations are facilitated by the low downward elasticity of wages and prices (i.e., if prices go down, then wages do not, since this threatens the loss of qualified workers) Government expenditures and taxes: Public, or government, expenditure refers to the costs of maintenance of the institution of the state, as well as public procurement of goods and services. Government procurement of goods and services can be of various types: from the construction at the expense of the budget of schools, medical institutions, roads, cultural objects to the purchase of agricultural products, military equipment, and samples of unique products. This also includes foreign trade purchases. The main distinguishing feature of all these purchases is that the state itself is the consumer. Usually speaking about public procurement, they are divided into two types: procurement for the state’s own consumption, which is more or less stable, and procurement for market regulation. Expenses